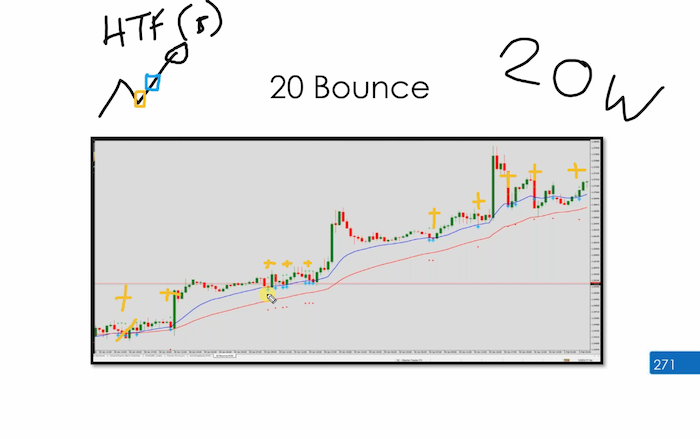

20 Bounce: It’s an intraday strategy, but because it goes on as a very high success rate in terms of reading the right zone can be done throughout the day.

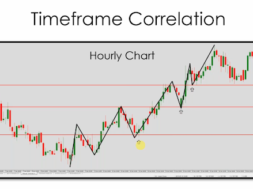

Some people even trade this early doors what is different to the 20 bounce compared to the others, because it is a trend strategy. Guess what? We always do always use time frame correlation. Always like to get in early after the cross, because this is therefore early is highest probable zone.

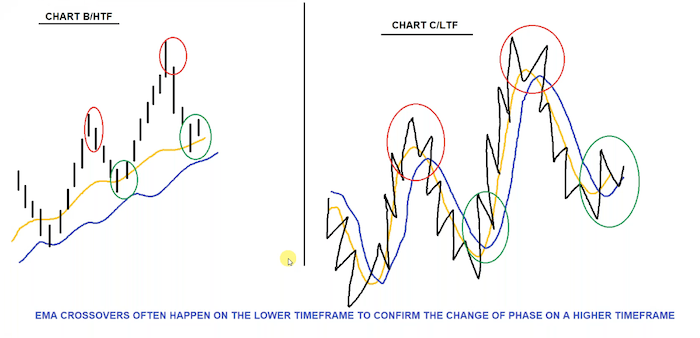

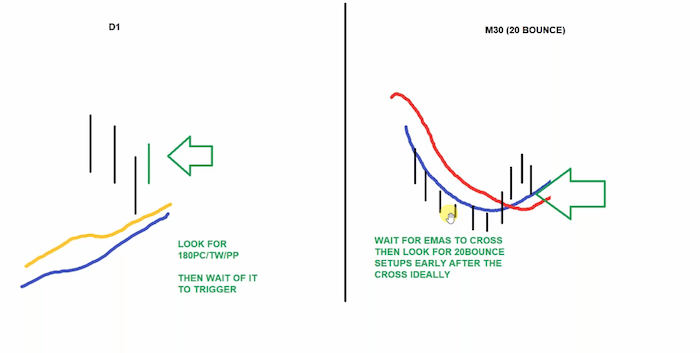

Is a powerful intraday trending strategy that harnesses Phase One trend trading without revealing the rest of the rules. We already know that we are looking for the higher time frame like this you want to get in the lower time frame early after the cross, and you see that this is a universal language.

Universal language for trend, trading higher time frame, trend, beginning of phase one, lower time frame, get in early after the cross, and with the 20 bounce once we get in after the cross, we keep buying. Gonna provide you with lots of signals. It says, use your discretion. But we’ve just covered what that is, high probability opportunity. Probability opportunities are beginning of phase one.

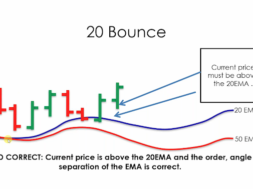

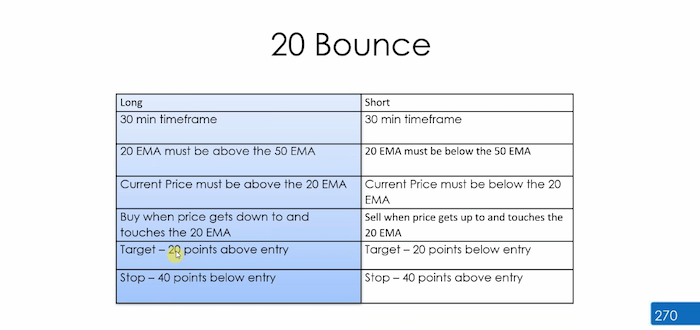

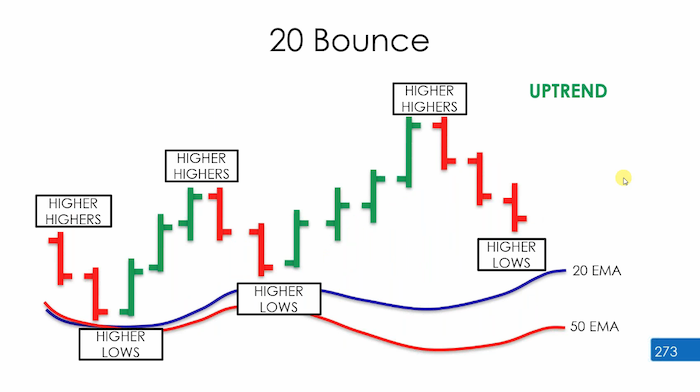

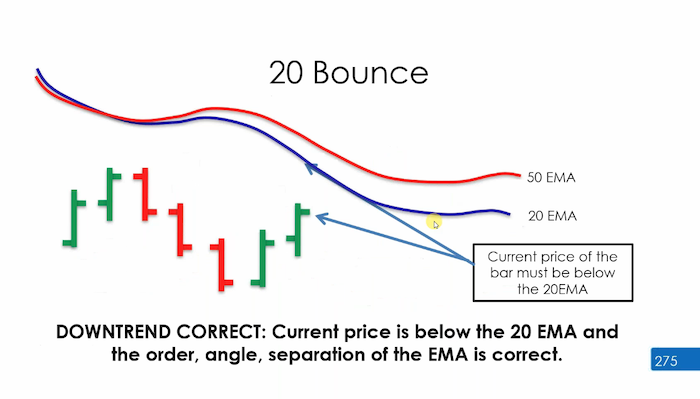

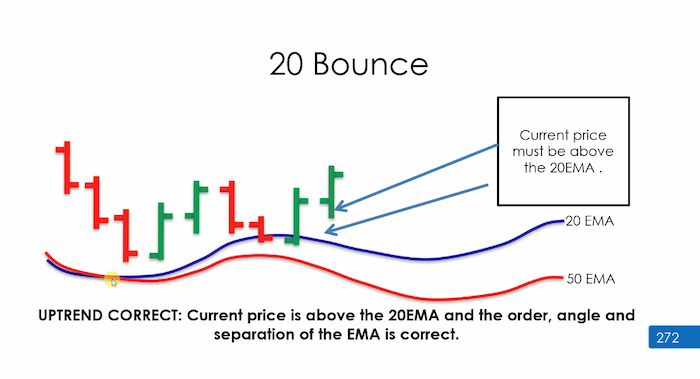

This is done on the 30 minute time frame. 20 EMA must be above the 50 EMA for long, below for short.

Current price must be above the 20 EMA, when price gets down to and touches the 20 EMA we buy, hence the name 20 bounce. On our trade Management Guide, I showed you that the unlimited snap back and 20 bounce are the two strategies default that are set 40 and 20 pips. Please do not ask me to change this.

That is you over complicating it. When you’ve done the testing and found this, and there are a couple of variations that I will share with you, but I need you to trade. This is an inverse reward to risk. Therefore it produces a lot of winners, because you’re winning 20 pips and you’re risking 40 the sell is the exact opposite.

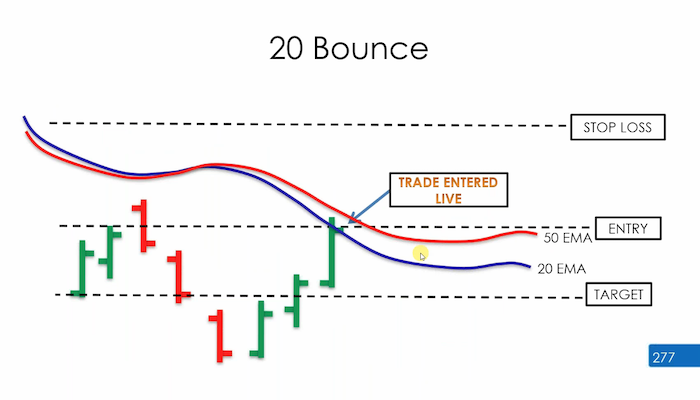

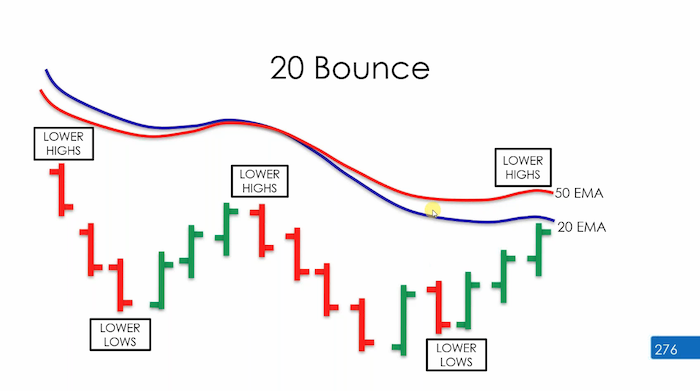

The 20 must be below the 50, and we are selling when the price touches the 20 EMA, now I have done something that you may or may not know, but I’m going to find out if you have been paying attention. Those of you that have been here before will already know the answer, but let’s see if you remember the answer.

For the record, every single one of these 20 bounces is a winner green dot is hit before the red dot? The red dots, you can’t see, they’re quite low. This is an entry off the line. Take Profit, stop loss. Every single one of these remember 40 and 20. This is what the 20 bounce stop or shoot behind that 50 and look every single one of these wins. We’re talking ….. There are 20 here,

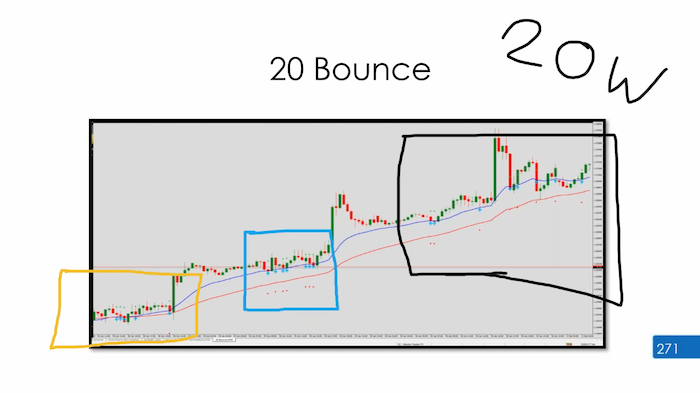

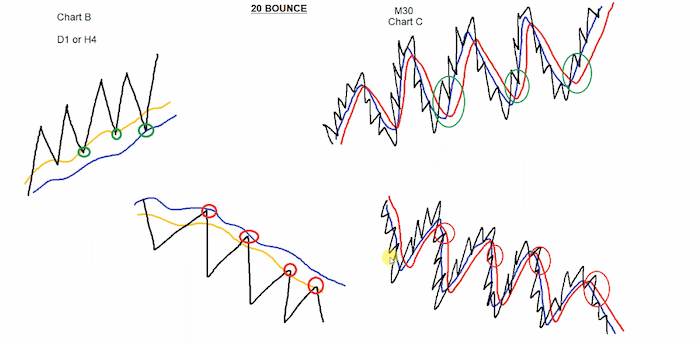

Which box, which box and why is the higher probability zone, as in trade entry, not that we’re going to win, but the higher probability zone to take a high probability setup trades can lose and win in every area, but which zone is better,

which box and why,

You’ve got gold, you’ve got blue, you’ve got red and black or yellow. Call it yellow. I’ve got it as a gold box because yellow is a little bit brighter. I’ve just given the answer, and it’s something we’ve spoken about a lot.

You’re getting the answer right, because it’s been drilled into you. So I know that there’s no messing around there. I There’s no mess about there. You guys already know this. You’ve been told it a dozen times.

So look at this diagram. Should give you the answer to your question. You are not allowed to think it is going to touch, you are not allowed to place orders IT IS PLACED LIVE.

What if I said, there is a universal proof for all. Traders that are trading trend should be buying early after the cross.

It’s the gold box in the previous diagram because we’re getting in early after the cross.

It’s the same general rule if you buy in the black box you are buying at the end of phase 1. If you want to put the odds in your favour, you must make sure you’re getting in after the cross.

But here’s how it works. You buy the 20 bounce in this zone. (gold)

Get a winner. Fantastic. Get another one. Get another winner. Fantastic. Take another one winner. You wouldn’t take more than one at a time on the same chart.

This is another one winner there, and another one winner. There are 10 official trades you could have done realistically. The good thing is, if you had missed this one, you could have got it here a bit later.

Please make sure you write this down early after the crossover. There is no getting away. If you turn up here later and trade, accept that you are later in the phase and a low probability zone.

Eight, high probability zones, yes, you still lose occasionally. But it’s a very cool strategy.

24 hours a day, trade it wait for the, touch after the cross, take the first signal, and after that, you keep buying. If you are comfortable doing so.

You need to see your higher time frame trending, otherwise, you’re going to be trading in the wrong phase. As per the manual. It says you should be trading in phase one. So you’re going to be trading in phase one. That’s where the most money is.

Because you’ve got the 20 PIP take profit, stop loss, your success rate will be pretty high on this if you do it correctly. Not we can tell very quickly the numbers will not be that great, but you’ll say, Oh, the 20 isn’t working for me, and I’ll know that you’re not doing something correct.

Get to adjust it together. So don’t feel bad. It’s just one of those things. Is a live strategy. You get in live at market price. Market bounces. Falls back by sell. We trade the 20 bounce.

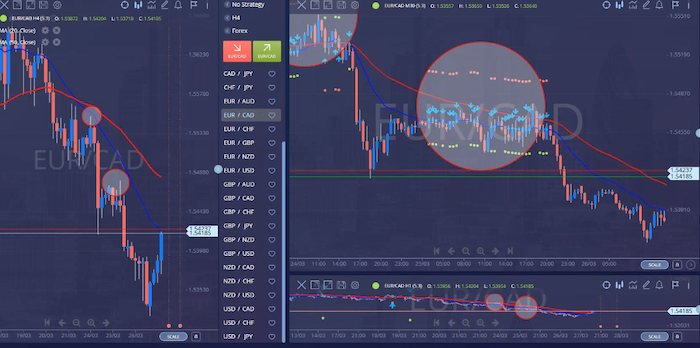

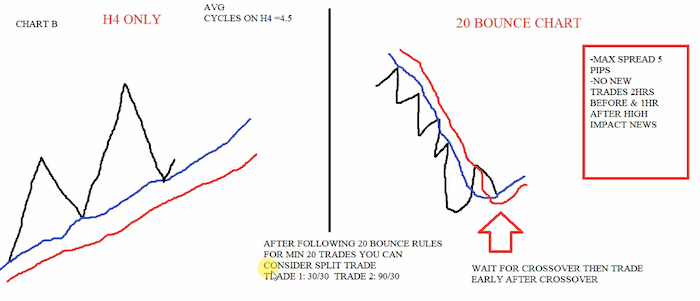

First and foremost, you can choose which time frame your chart be. So on my key, I have said that the higher time frame for a 30 minute strategy is a four hour H4. However, we do have a few scenarios where we give you some different rules.

Some of you will prefer to wait for the daily to be your chart B to give you changes of phases like

This, this, this and this, you are going to get in 20 bounces early after cross. It doesn’t get any easier than this once you’ve bagged here and continue buying or continue selling. No 20 bounce, no trade. Not allowed to think it’s going to touch. You’re not allowed to place orders. Is only placed LIVE.

This makes sense, nice and simple for you, doesn’t it?

Because of the inverse reward to risk twenty bounce works extremely well, so I want to see a simple cross, (on cross hairs) I want to see space, take profit, stop loss, sell. You are NOT to close the take profit early, not to do anything, set and forget.

This is a strategy that I’m giving you strict rules on. You’ve got the general rules of moving stop losses and all the other things not for this one get in. Stop Loss is 40. Take Profit is 20. When you’ve done this better, you’ve done it for a while. We will show you how you can tweak it, this crossover, 20 bounce, Target.

It has a high success rate because that stop loss is generally outside of the zone, but it eventually will reach its take profit, there are lots of signals you wold have taken one of these. You wouldn’t keep buying them, because that’s too much risk.

After the move keeps going on. Look what happens. You get four signals at the end of the phase and the market changes direction.

3.48.56

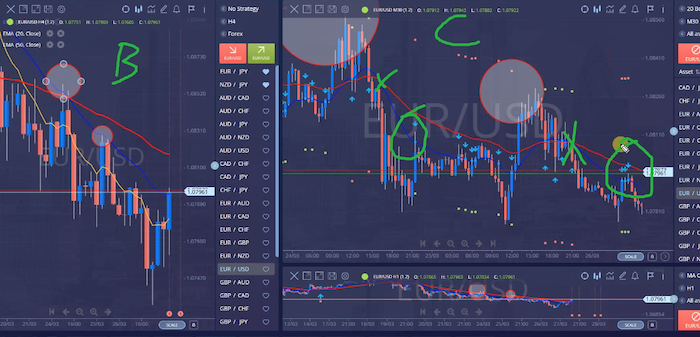

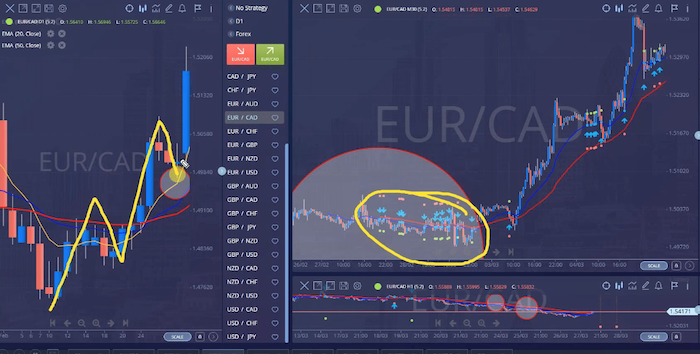

Let’s have a look at this. If we go to the four hour, can you see we’ve got the downtrend. What I’m looking for is the beginning of phase one.

I am trading in the direction of the trend. Look at this by the timeframe. Chart B, this is my chart C, there’s my crossover (X) and there’s my 20 bounce. (Green circle)

That is how the 20 bounce is traded, just like the 180 wave, except you’re not waiting for a particular bar. You are just getting it the minute price touches the 20 moving average. (20 EMA)

Using the four hour will mean that you are not going to be getting trades that do this. Just to warn you, you’re not going to get any bounces off eight EMA that will produce a crossover. You want to see the crossover using the four hour, you will need to see the price come back to the 20 EMA.

So what we’re going to do on this euro chart is, if the Euro continues down I’d like to see this happen. (light blue and pink curves),

Price would need to drop and hopefully give us a sell signal.

The 20 pounds is an abundance of opportunities. It’s a brilliant strategy. I would say is probably our most popular strategy.

You can see why people just love the 20 bounce.

This is why I said you’re not going to get crossovers unless the price comes back to that 20 like now, look at this. Now. Price has come back to the 20. We’ve had a cross.

Look that circle. (On Left hand chart) We pulled back to the eight, no crossover.

You would need some more knowledge on this, and that is about this in Advanced Boot Camp. In boot camp in February, I covered this where we spoke about looking at the break of a trend. You know I’m talking about, you could use that to advantage.

If you want to use the four hour, then please look for it to come to the 20. Keep an eye on stuff like this.

It almost did cross. So this would have been okay. While it’s about, it’s why it’s about trial and error. Let me show you why the daily is used in many cases.

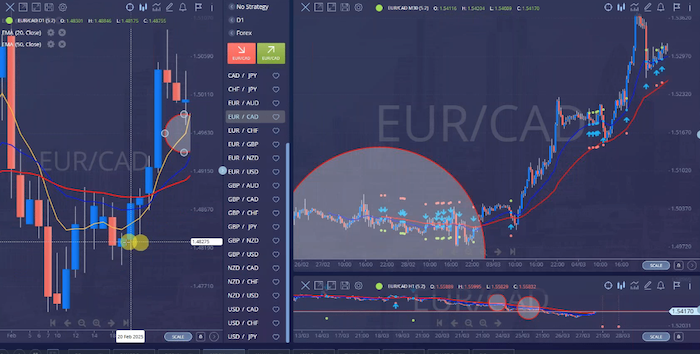

The trader looking for the daily to be their two cycles look (on left hand chart) one cycle, two cycles.

This is phase one can come back to any average, because it’s a daily it will likely come upside down and see that this sell zone not correct, because the trend is up.

Look at this. There’s your cross. (to the right of yellow circle) There is your buy and all of those up would be fine.

This is how the 20 bounce works. There’s the D1 daily This is probably the better example I can give you this is the sort the sort of 20 bounce you’re looking for.

There are a few rules around this. So you’ve got this as your guide, obviously written down getting after the cross. You’ve probably written that down multiple times because it comes up in of the trending strategies. The 20 bounce requires a few other things. I’d like you to know if you’re going to use the four hour H4 you are going to follow a set of rules.

If you are not new, here would be looking at this.

So this is not for those of you who are new. General rule of thumb for the 20 bounce is, if you’re going to use the H4 wait for the market to come back to the 20 or 50 trade, then trade after the cross.

In general, this part is for everyone. So this is for everyone. The maximum spread. You would have noticed the Euro chart had got a spread of 5.3 that means not traded it (RED BOX) Spread has to be a maximum of 5 PIPS

Maximum spread by pips. Why? Because you are going for 20 NO NEW trades two hours before red news and one hour after the red news, its a 30 minute chart so you need to leave the market alone. If you’re in a 20 bounce, that’s fine. Leave it to run, and let the news take you out.

Or if you do not want to be in the news, you have to exit before the news and wait an hour after. those of you that have been trading the 20 bounce and have got to your 20 trades, you know a bit more about the 20 pounds you might feel that you want to change your rules to the following is where we go, 30:30, and we split the trade in half. We have a stop loss of 30 and a target of 90. And a stop loss of 30 and a target of 30, that becomes a three to one and a one to one and what you’re doing is splitting the trade.

This is a type of scaling out without manually doing it. Some of you don’t want to change, but this is just something a lot of us do. Some of you like the 20:40 because it gives you lots of greens.

The 20 bounce can be your best friend. If you mess it up, it won’t work that sound very silly what I’ve just said, but that’s just the way it is.

It’s a very, very basic strategy you are trying to get in early after the cross. Do not mess this up. If you turn up late in phase 1, don’t expect miracles. Get in early. If you miss it, wait for another one.

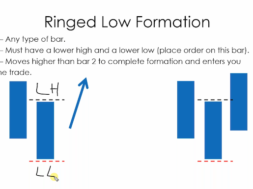

The signal is generated as it hits the 20 EMA, if it goes through wait for it to get close or on to the 20 EMA then trade BEFORE the bar closes if it is below the no signal will be generated.

Now we like the 20 bounce with the daily because it works quite nicely with something else I’m going to show you. This is why the daily is (Dailey higher time frame)

high time frame, and you might be looking at a 180 or a T wave to trigger this is a good idea or Power Pivot. Why do we use the daily? We use the daily because this works in conjunction with this strategy. So bear with me this works in tandem with another strategy called the Master Crossover which is the next one to look at.