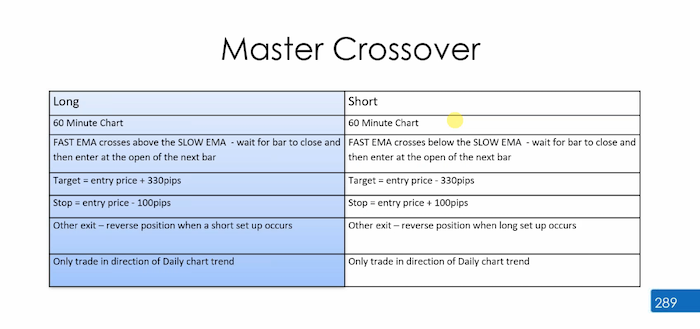

MA Crossover: This is an official strategy that gets you in with a crossover. With the chart sending a signal when the 20EMA crosses the 50EMA with a target of a three to one, the stop loss is going to be 100 pips. There is an alternative stop loss, which we’ll talk to you about in a moment. All the numbers presented on the strategy, have been tested.

The basic advice is that you shouldn’t question why is a stop loss here and why is a take profit here, it is basically filling your brain with information that you simply don’t need.

We have been down that road before. It’s a dangerous road, a slippery slope. It leads to over analysing and not doing what we need to do.

So stop loss and take profit have been tested. That’s why they are the way they are. But I’m going to give you some additional rules to improve the use of this strategy.

The rules we’re going to be using are that the 20 and the 50 moving average get you in and we can get out with the averages crossing back or do a simple 3:1

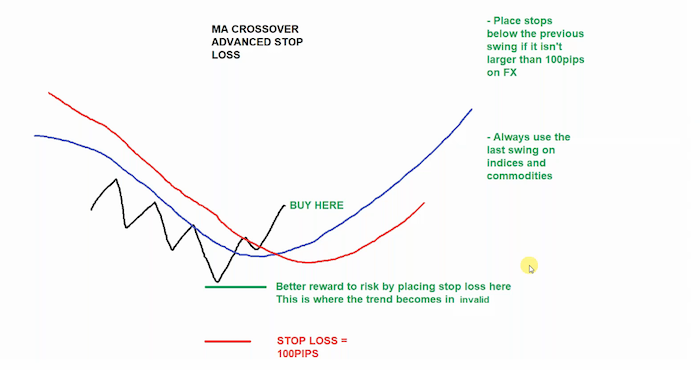

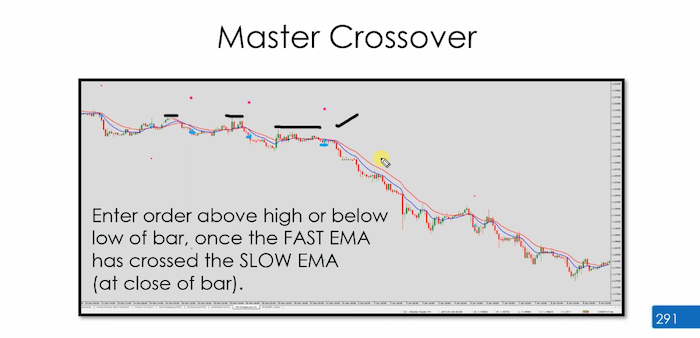

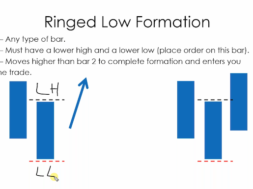

So when it comes to trading the MA crossover, we’re going to buy here, where the EMAs cross and this is the MA crossover with the advanced stop loss. It stops below the previous swing. If isn’t larger than 100 pips on Forex , 100 pips is the maximum because we are trading on the 1 hour chart and when we look at the screenshots, you’ll see why this works.

When you’re looking at indices and commodities, please always use the last swing, because they’re a lot more volatile. They have bigger swings. Please always use the last swing. Using the last swing on forex, you’re going to get a better reward to risk, because sometimes that stop loss will be 40 pips, or 20 pips or it’ll be 80 pips. Will be 65 pips. It varies.

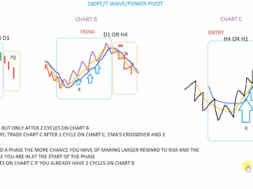

The MA crossover is to be traded in the direction of the higher Time Frame which is the daily D1 chart.

Higher time frame is the daily that will be trending down. Your rules would have given you a setup right here. You can see the stop loss would be 100 pips. Everyone see now why putting the stop above the previous sweep would have been best.

Look at this one, previous swing, previous swing. There are three opportunities that I like to buy. You get what I’m saying. Look the blue is the entry. The black is the advanced stop loss. Do you now know why? Does it make sense, why we would have wanted to put the stop loss there?

Brilliant isn’t it? A real eye opener because I’m not just putting it somewhere random, but you’re putting the stop loss there because you’re saying, I need you to make a higher high, not go all the way up here. So what you’ve done, very quickly here, is you’ve just changed your reward to risk and made it easier to get a three to one. So that three to one is what you need to change it to. It’s 330 pips That’s a number we actually found, which works really well.

If you’ve got 100 pip take profit you end up with a 30 PIP stock. Then do that with your reward to risk. Or get out when the averages cross, get in with a cross, out with a cross. You know, had two bites at this. First In, out, in, out, shake it all about.

You didn’t make anything here again, but this time, you won big!

This is why I like giving you this. Look at the MA crossover. It doesn’t need any bars. It gets you in when the averages cross. Your stop loss would have been here, see the 100 is down here. Stop Loss goes there instead of there, unless it’s a commodity or indices.

So, so this daily chart, can you now see why I’ve got MA crossover and 20 bounce and a daily chart all on the same page?

Because if I get in at the beginning of phase one, look at this. Look at this. This, everyone. This is what I’m trying to get you to see. I am analysing my daily trend. Do we have two clear cycles here? Let’s just double check, make sure everybody’s happy. I’m not using the two bar rule, as you know, because happy we’ve got two clear cycles on Chart B, yes. Have we seen an EMA crossover? Can we get in with an MA cross? Yes, this one with 100 pip stop loss would have been a winner.

people stop loss would have been four. You know, stop loss, let’s call it 65 pips. If you had done this trade, MA cross, is what would have happened. We’ve got the three to one easily. That’s 330 if you did 65 you’re gonna easily manage your three to one if you got out with a crossover. Thn using the Fibonacci extension turned into a reward to risk calculator.

We cover this in boot camps. This trade would have taken you out there, meaning you would have made 8:1.

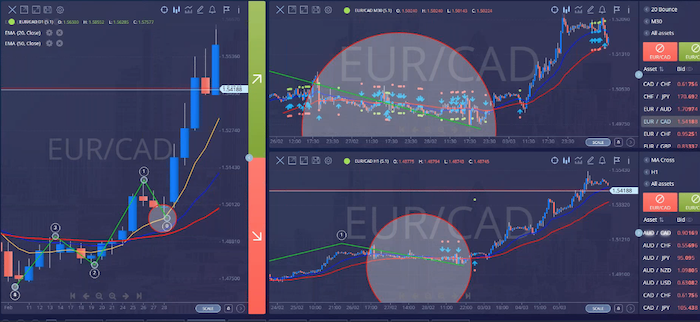

Euro CAD would have produced eight to one in March.

You took the last and they crossover on eurocad and

got out with the crossover made it eight to one. If you set a three to one you would have made a 3:1.

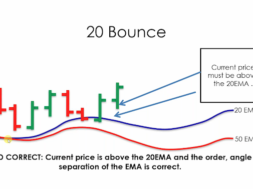

If you decided to do 20 bounces, you would have caught a few 20 bounces, 5, then you would have stopped and tried to get in again. Can you see the power of trend trading the MA cross and the 20 bounce work really nicely together.

Some of you will like to get in with the MA cross and scale in with the 20 bounce. MA cross suits those of you that are really busy. 20 bounce suits those of you that want an abundance of opportunities within that whole move. This is a perfect example,

to be fair.

Very important question that’s been asked here, shouldn’t there be two cycles after the cross? If you’re a beginner, yes,

when you spend time with me in this course, when you’re one on ones, I’ve never said that to you. Probably just not noticed it.

I did this on day one. If you remember, I hid everything. I said, price is key. Moving Average is just a bonus. If I’ve got two cycles, I’ve got two cycles, two cycles after the crossover is something you would have been taught and beginners to make it easy for you.

Once you get to master trader, you’re playing in the big girls and boys League, you don’t need two cycles after the cross, otherwise you will miss a lot.

That could be a big game changer, because if you would wait for two cycles after the cross, this is now your second cycle. You can see you’ve missed the end of a lot. So no thanks a million to two cycles after the cross now you know why.

That’s the sort of question that does contribute what I get it now.

You can combine the Ms cross with the 20 bounce because it does exactly what you’re seeing here. The MA cross will only give you one signal. So this is where the problems begin.

If you were not there on the third of March at midnight, UK time, he would have missed this trade. However, this dot is what?

What is that dot? It’s it is highlighting a what. Answer begins with P 5, letter word. What is that dot represent? It’s a five letter

word. Guys, five little words. I’ve just circled it. I’ve just circled it. Guys, five little word.

The price, the price we’re talking about this is a price. This blue dot is a price. So what am I about to say? Everyone midnight? Maybe I’m sleeping. Maybe already and sleeping.

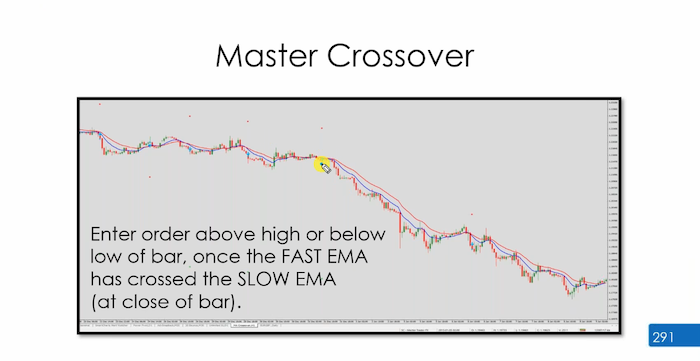

What does the bar possibly nine hours after because we look to buy at a price at midnight, but we were not there. What could we then do, knowing is the entry price? See, if you guys are paying attention, I’m sure you’re going to get this. What could we do, making as obvious, but if not, I’ll give you the answer. Could we then do knowing that is the entry price, but we missed it?

Wake up at six o’clock in the morning, what could you do waiting for price to get back?

That’s one option, or place an order. That’s exactly the exact answer looking for because is the entry price. You don’t need to be there.

As long as price comes back to the entry price, we’re allowed to get in, even if it comes back 24 hours later, so long as it hasn’t hit the three to one trade is still valid.

Because MA cross is only going to flash for one hour. That’s why there are hardly any flashing signals on the MA cross every month. MA crossover flashes for one hour, if you are not there, the arrow will stop, and if you wake up at later date, later date.

Look at that. That’s about eight o’clock in the morning.

This is super important, because I know some of you will feel that you’re not getting enough signals on this. You don’t need enough, you don’t need many signals. You just need to get in off the cross traders.

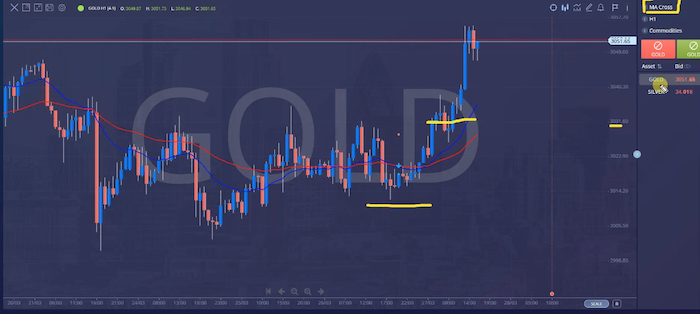

Sometimes the signal will not even appear at all Please write that down here they cross over. Here there’s no good signal, guys. Why is there not a good arrow? Because the way the signal works, it wants that particular bar to break go above it. If it doesn’t go above it enough, it will not generate a signal. Guess what you’re going to do? You’re going to write down the price. This is the entry price, 303, 1.60 I know that’s a cross so far, but no, I want to buy gold.

You manually put it in and you manually type in that thing, type MA cross to get in with gold. You log in and place the order.

That is the entry price. You don’t need to be there as long as price comes back to the entry price or allowed to get in, even if it comes back 24 hours later, as long as it hasn’t hit the 3:1 the trade is still valid.

Yeah, I know it’s not as easy at first, but when you see it, you go, of course, yeah, it makes sense. I want to give you the expansions. You can all see our course value, yeah, you’re right, because MA cross is only going to flash for one hour. That’s why there are hardly any flashing signals on the MA cross.

Everyone MA crossover flashes for one hour. If you are not there, arrow will stop and there will be no signal. However, market does come back, and if you wake up at later date, later date, look at that. That’s about eight o’clock in the morning, 11.0 broker time. If you woke up at 7.30 and saw the market have fallen below the entry price. Go to your no strategy. Place, the entry at 50366, place, your stop loss is the 100. You put it below the swing, you are in exactly where trader that got in at midnight got in.

Traders, do you understand this? This is super important for you, because I know some of you will feel that you’re not getting enough signals on this. You don’t need enough you don’t need many signals. You just need to get in after the cross, sometimes the signal will not even appear.

There we go. Yes, this is super important. Aha, good. Please write that down. MA crossover here, no blue signal. Guys, why is there no blue arrow? Because the way the signal works, it wants a particular bar to break and go above it. It doesn’t go above it enough it will not generate a signal.

Guess what you’re going to do? Going to write down the price. Is the entry price, 301.60 not going to argue. I know that’s a crossover. I know I want to buy gold a stop loss. Man, he said, to go below the previous swing traders. You manually put it in and you manually type in that name, type in MA cross to get in with gold you are in.

So, Yes, I

I guess.

Are we doing? I it may let me know your thoughts.

Theses strategies are really liked because we know more soyou could go with a 180 phase changer but rather than getting in on a 180 you can get in with an MA cross on a one hour, meaning I can get a smaller stop loss.

REALLY IMPORTANT . 20 bounce is Forex only. Please. 20 bounce is Forex only. 20 bounce is Forex only. I’m repeating that a few times because nobody should be trading 20 bounce on commodities and indices. It is not designed for that. Stop losses don’t work.

A crossover, everything, Forex only 5 pips spread max. So this will be ignored. You’re going to trade the MA crossover here when you get a buy signal, there’s no buy signal, but you override that and get in yourselves, rather than getting in with a 180 phase changer or a power pivot or a T wave, I can get in with an MA cross.

I will typically get a smaller stop loss. As I’m using a one hour chart, this strategy works really, really well when it doesn’t work well, well, it doesn’t work well. Show you a sell example.

There’s a phase one changing phase. Here is a sell example. Sometimes the 100 pips stop loss is enough. There’s your stop loss is the 100 pips. You can see it’s not too dissimilar. So I’d run with that, as long as it’s not more than 100 it’s my entry. Get in with the cross. Look for a three to one, and you can get out with the cross. This one does happen to make your three to one.

It did eventually make it properly here. Or you get out with the averages crossing. The purpose of getting out with the cross is that every now and again, you’re going to get a massive reward to risk. Sometimes it will stay, it’ll stay, it’ll stay, and that’s how we use it.

Are people’s results better with these extra strategies? No people’s results are better with better timeframe, correlation, timing and it, and finding something that suits you, 20 bounce is amazing. But guess what? I don’t trade it. Why? Because It doesn’t

Suit My lifestyle. Can’t trade the 20 bounce because of the life I choose to lead. If I trade the 20 bounce, my results will be terrible.

Did you miss that can’t trade something doesn’t fit your lifestyle. Problem with the 20 bounces. If you’re very, very, very busy and you’ve got a very random, sporadic day, you’re going to miss the best trades, something that you have to be present for, not always, but you need a nice slot to be able to catch them. I had tried in the past. It didn’t work too well, as in, results were fine, but I missed too many. It didn’t work. I wasn’t able to capitalise on the moves because I’m missing them. That makes sense.

The trade is done on a 30 minute chart. It’s got nothing to do with the daily and four hour you’ve got to execute on a 30 minute chart. So the daily in four hours got nothing to do with it. Please don’t just choose the thing that you like. This is where people get caught out. You can’t just choose the things you like, because if you choose the things you like, you’re going to be in trouble because it looks nice.

Some of you have got too much time on your hands. Some of you got too little time on your hands. Some of you are going to be 100% better just trading a daily chart because it works. You don’t miss as many and it’s just easier, and you will still make same numbers trading the daily as the person trading the 20 bounce or the MA cross. For example, I’m in gold. I’m in gold already. I had an order placed on gold two days ago. Guess what? If I waited to trade the MA crossover that happened at 3am guess what that does? That annoys me because I’ve now missed it. I had to learn the hard way.

Ma crossover triggered at 3am for gold, but I’m already in because I placed an order for our so I already got in on my order, which was placed two days ago. Happy days. Do you understand that? The key is that I wanted to buy gold. Doesn’t matter where I get in, just I’ve got to accommodate my lifestyle. This is why you guys need to have these raw conversations with us.

You do the school run? Have you got a partner? Who do you live with? Do they agree with what you’re doing? What is your work hours like? Do you drive to work? Do you walk to work? Do you commute? Do you commute? Commute to work? You really tired at night? Are you an early bird? Can you stay up late? What completely give you something else, or say you’re not going to do the MA cross or the 20 bounce, you’re going to do a bowl reversal, or you’re going to do a power pivot on a five minute the goal is to get you in phase one. Traders, it is break time. You’ve got an hour to go and have some lunch and some.