Ringed Highs and Ringed Lows: Okay. We’re going to talk about ringed highs and rings lows. Ringed highs and ring lows is what makes a 180

I want you to focus on the simplicity of what a ring high and a ring low is a ringed high or a ringed low is the term used to identify the price bar that sits at the top and bottom of each market suite.

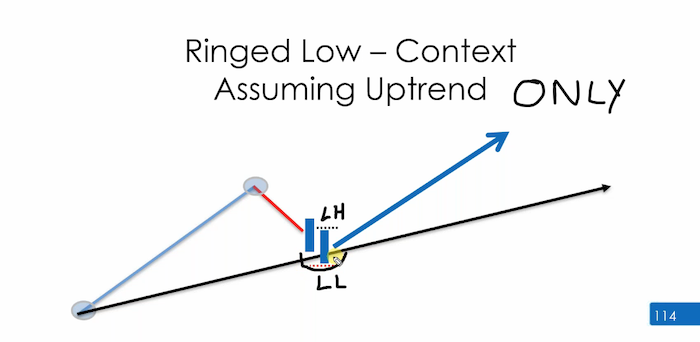

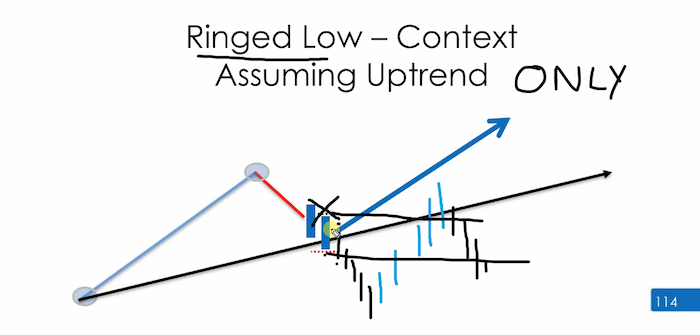

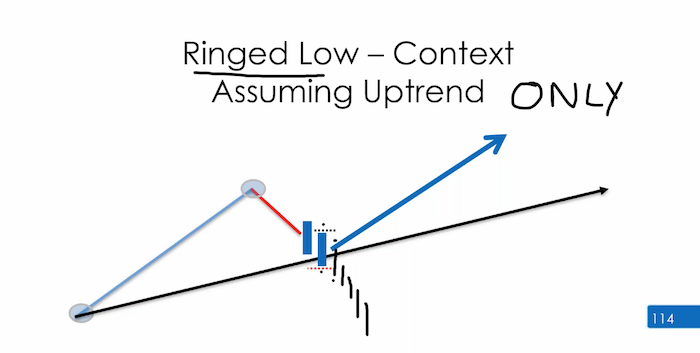

It’s even nicer if price action supports a reversal. So we’re talking ring low with, you know, a low test as well, or a high test. But it’s not a must. You need to be aware that ring highs and ring lows are far more comfortable to trade with the trend or at the tops and bottoms of ranges. We don’t trade it against the trend. This is due to increased chances, chance of success, improve water risk when trading with the one dominant trend, because the market is expected to continue. Markets do this more than they don’t you got so check this out.

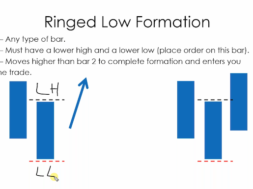

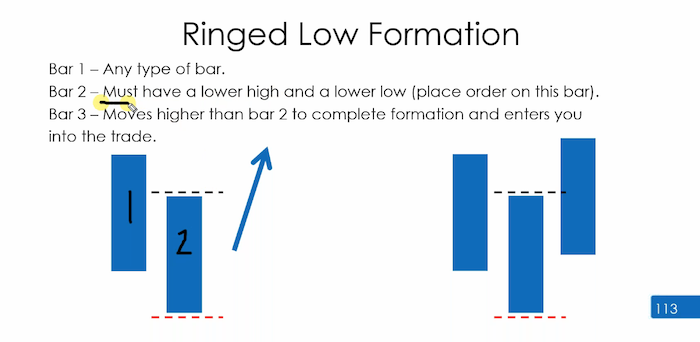

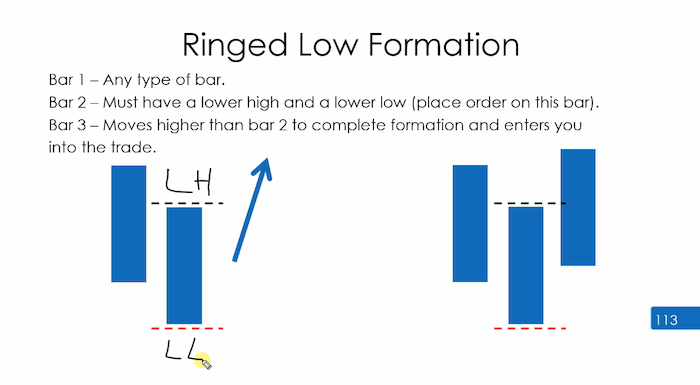

If you want to know what the ring road is, without any fluff or any anything else on top the bars you see here, I know they look like candles, and they are, the bar you are looking at is making a lower high and lower low. We’ve not highlighted the open and close because we want you to focus entirely on the low and the high, believe it or not, that is all that makes a ringed low

This is all that makes a ringed low. Ringed lows are old bars. They’ve been around for years. If you are looking for a ringed low on any time frame and you see one it can be traded. However, the 180 only flashes on the four hour and the daily. Because we’re doing master trader, you can trade this on a lower time frames. So if you see any bar in an uptrend, (ringed lows in an uptrend only) if you see any bar with a lower high and the lower low, any bar so the colour is irrelevant. The size is irrelevant. If you see a lower high and lower low bar. That is a ringed low. If you see one bouncing off a trend line, a moving average, or a level, that is a tradable opportunity considering you’ve done your timeframe agreement. It’s called a ringed low, because by the time the market takes off, it’s a small ring.

I mean, name is a bit bad, but whatever, we didn’t name it. It’s just one of those things. I forgot the author of ring lows. Murphy (New York Institute of Finance) is often associated with the concept remember his name, but the very old patterns you are looking for any bar with a lower low and a low high.

Here’s a question for you, if the market does this?

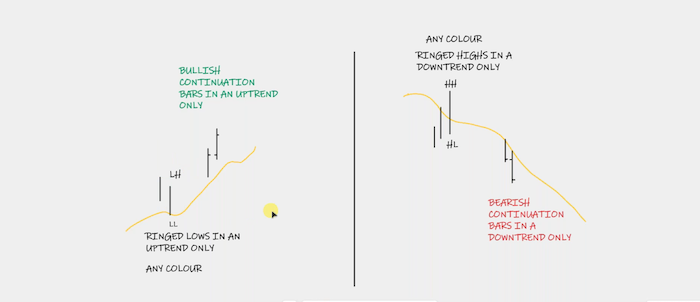

Is this now a ringed low? I’m not doing it open and closes because its not important. So, yes, correct? No, it’s not a continuation bar. We can only have bullish continuation bars in an uptrend and bearish continuation bars in a downtrend. If the bar has a lower high and the lower low as as I said with this one. It is what it’s a ringed low. How many ringed lows have we got now?

1,2,3,4,5,6, every single one of these bars are a ringed low.

1,2,3,4,5,6, every single one of these bars are a ringed low.

Whether the market goes up or not, is its prerogative. We would then go up. I got bought in here. So when you place a 180 phase changer, you’re actually meant to have it expire on the day or the bar, because I don’t want to be brought in here. This is what happens to some people’s trades. It brings them in, does that, and it kicks them out. They get bought in here and get taken out here. What you’re meant to do is cancel the order, place the new ringed low, cancel the order, and place the new ringed low.

I was going to show you something when I changed my mind, and I’ve changed my mind again, because I was going to save it until the end, but I’m going to do it now, because whats been asked. I’ve made these neutral colours, so you understand that bullish continuation bars are found in an uptrend only.

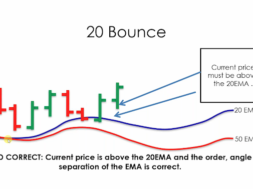

What makes a bullish continuation bars? A bullish continuation bars is a bar that is making a higher, high and higher low, as we did on day one, and the close and the open are far from each other. That bar would need to be a green bar.

So this is what you get in an uptrend.

Only Angela, everyone else, yeah, so I know why you wrote that. It’s very confusing. This is probably one of the most confusing things to start with, the bars you go, I’d ring high. Why is it not a continuation? It’s because it isn’t it’s just a weird rule. In an uptrend, you need to see a ring low. In an uptrend, you will see a bullish continuation. Ring lows can be any colour. Continuation bars will be green. In a downtrend, you will see bearish continuation bars, and you will see ring highs only. It’s about repetition. Once you repeat this, you’ll just get it.

So please remember this bar 1, bar 2 must have, must have a lower high when we do this at the end of the everyone, this is what we are focusing on.

5.43 day 2

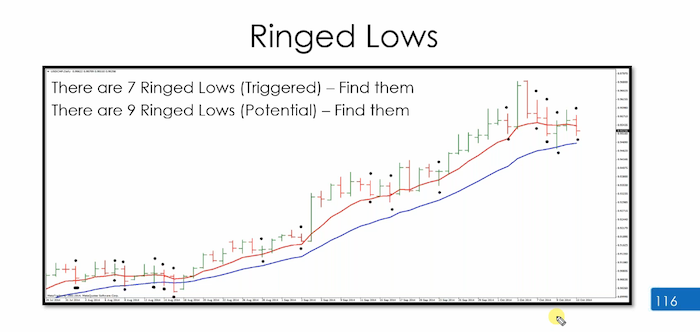

Every single one of these bars that has a lot of the lower low than the previous bar was a potential ring low. I’m not going to talk about the ones that have triggered because I want you to focus on recognising the bar. Not all of them are tradable, but that is not our concern. We are concerning ourselves with what is the rings. If I can get my eyes accustomed to seeing this, it means later on, I can trade ring lows on any time frame in the future.

I might want to do some investing on a weekly or monthly I can find a ring low. I’ve highlighted every single bar that has a lower high and a lower low than the previous bar. Those are my ring lows. Whether they can brought me in is irrelevant.

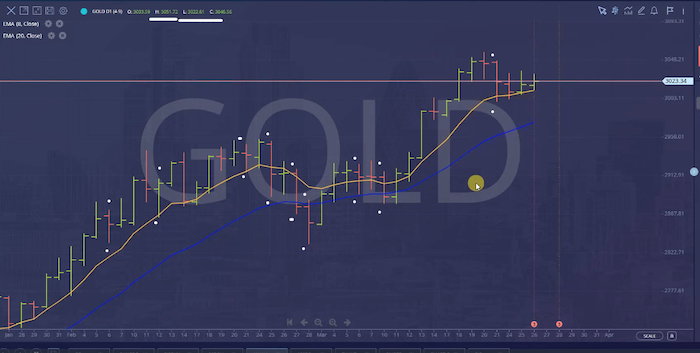

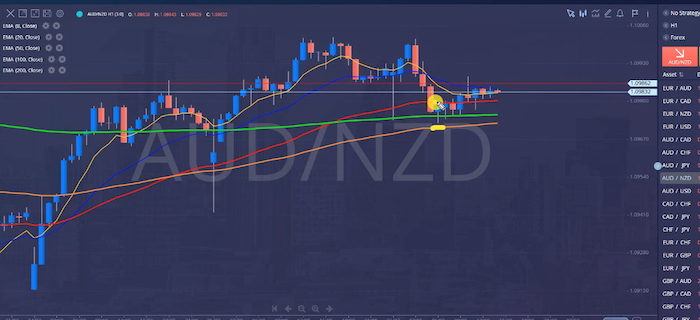

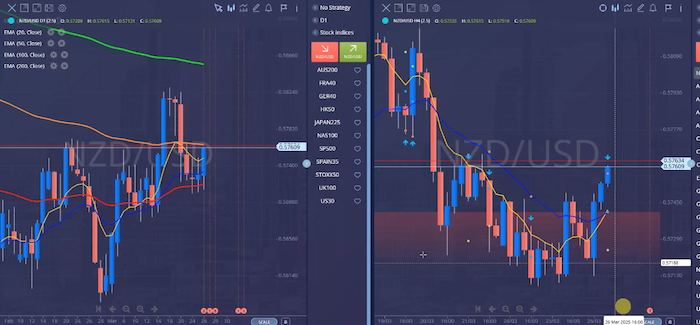

Now it’s going to be your turn. We’re going to go to a live chart, because I’d rather you do this, not with the 180 now you’ll understand why the 180 is flashing. This is flashing because that bar has got higher, higher and higher. This one hasn’t finished yet. Yellow is also below the blue. That’s what makes it trigger. But what we’re going to do is get rid of this. We’re going to go here go.

Let’s do it. Let’s go and go. You’re going to give me a yes or no. I’m going to change it back to OHLC bars, because I think it’s easier for your eyes. Please remember to dismiss the colour, dismiss the colour, and start with OHLC bars. It’s easier for many of you to do it this way. You’re going to put Y for yes and N for no in the box, is this this bar still forming? So we’re gonna leave it. Is this a ringed low? No, it is not. Is this a ring low?

Is this a ring so so far, everybody’s been accurate. When you’re doing this exercise by yourself, you need to do it exactly the same way. What tends to happen in the group environment is, I ask you guys ask, and everyone gets it right. When you go off and do the exercise by yourself. People make lots of mistakes. You need to replicate the same way we are doing this. None of these are ringed lows because none of them have gotten lower highs and lower lows Correct. Where is the next ring low if we count backwards, this is bar one. This is bar two. Tell me whether the next green low is, what number bar is it? See if people are paying close attention, yeah, yeah. See the fact that you’re getting this right? Exactly. Bar 5.

That is a lower high, that is a lower low, not quite bar six. Someone said six, no, that’s got a higher high than that. Remember, you’re comparing this bar. This is a ring. This is not, this is not. This is not. Is this a ring line? And I’m using epic pen to draw, so I’m specifically checking, is this a ring light? Is this a ring light?

Yes, fantastic. This is not. This is No, no, no, no, by the way, if you look at a bar because accurate, what you do is get the pointer and stick it on the bar. It will give you a reading for the low and the high. If you’re unsure about the low. Just move across. You’ll see that low is 28786 and this 22876 so you know six is lower than eight.

This is an inside bar, because sometimes this is obvious, but some of them very close to the bottom. So just bear that in mind. No, no, yes, here’s a ringed low that is also a lot. No, no, no, yes. Ringed lows, traders, does it matter for the exercise, does it matter what colour it is? In general, this test you before you’ve gone lows and ring highs do not matter. Does the size of the bar matter?

Correct? No. Size, colour doesn’t matter.

When we are trading the bounce off the average is important. But for the exercise you’re about to do, I don’t want you to focus on the price bouncing off the averages. What I’m going to give you an area based on the yellow being above, I’m going to ask you spot and count and tell me how many Ringed Rows you can find. That will be the exercise. So I’m going to pick a chart of my choice I’m going to go to a specific date and time, and I’m going to ask you to tell me how many ringed lows you can find. Please go to Australian dollar/yen on a no strategy chart. Please do not not use my chart. Do not use my chart, otherwise you won’t be accurate, because there are lots of bars that may not be obvious, and you’re going to need to check behind them. Please double check. Triple check you’re on the right time frame. Triple check you’re the right asset. You’re going to go through the chart in silence. I’m not going to say anything. I’m not going to count on the screen or with all the answers after but I’m going to go quiet, and you’re going to tell me after counting twice, how many ringed lows are on the chart. Yes, see in this box.

Have a look at the date. It’s the 24th of September, 2024 I want to know how many ringed lows were on the on this day. We need to count twice to make sure the numbers are accurate. If you get different numbers, you need to count third time. Once you’ve got your final answer, please write the number in the box. Everyone okay with that? Looking for ringed lows take your time. We’re going to try and get everybody in the same I’m going to go silent, traders, and count in the background, reveal the answer shortly. Everyone know what they’re doing. Make sure everyone knows what they’re doing.

Scores coming through. I’m going to say your name and I’m going to tell you what to do.

I’m going to report the answers in a few seconds. See, it’s about having a go, right go, and making your error and then being corrected and well done in found it good, good, good, good. And when we do this, we it’s not about the mistake, it’s about asking, What did I do? Would I do to miss it? There were 10 ringed lows on this chart. There was one or two that needed extra checking. If you found all 10, well done. If you missed it by one two, that’s fine.

We teach you fast techniques. Please go to GB pound/kiwi. We can look at January, 29 until today. Today’s bar is still forming.

So even if you were to count it, you can see it’s not a read. I’m going to start off by showing you the first read. Low this high is 20674, this height is 20656 very close. This is the first ringed low. The good thing about ringed lows is they’re running. It’s either a ringed low, it’s either higher. So you don’t even need to worry about, we’re going to go again. And you know what? If the penny drops for this ringed lows, you make sure. Don’t have to keep studying it. If not, then during the break, you might not just do this exercise and then, with no strategy, by the end of that day, you can move on to the eyes your comprehension much better. Please count all the ringed lows again come twice, double check count three times. I want to get some answers through very well done. I’ve already counted so I know the answer. I’m going to do is reveal the answers with you.

Well done if you got 11, well done if you got 10 or off if you missed it by one or two it’s not the end of the world. We celebrate that we’re making progress, that we understand we’re getting there.

Any questions on this, we’re going to do one more if you’ve got any questions. Done 2 already time to switch over to ring highs. So if you can imagine, everything has its opposite. What makes a ring high a ring high the exact opposite. We need to see a bar with a higher high and a higher low than one. Bar two. A ring high can keep going and going and going, you cancel that order. You place the other one at that doesn’t go, you cancel that, you place the other one. That is really something to keep an eye on. A ring high is that ringed. That’s the idea, we are looking for ringed high downtrend only, do not look for ringed highs, because it would be a continuation bar, and that is where the confusion starts with. What is the ring high we want? We’re here. We’re looking for any bar, every bar, regardless of the colour, that has a higher high. and a higher low. Is this a ring high? That

one here, exactly these. You can see not really highs, because they’ve got lower lows. You don’t even need to check the heights. But the minute we go back further, you notice that high and obviously the ones that we are interested in trading eventually will be the ones off of an Moving Average like that or like this, ones that are not bouncing we leave alone.

Here. All in guys can be traded on any time frame and in the way we’ve been discussing. Let’s go to the chart. Let’s look for some ringed highs guys. Shall we do a quick section together, and then I’m going to let you do your own money. Right? Let’s start from this. Is this a ringed high? High ring, high testing ourselves? Yes, it is, is this a ring high? I’ve got a lower high. Don’t forget, check your high, check your low. If you’re not sure, is this a ring high? Remember, the colour is irrelevant. This a ringed high, the serene high.

Need to check this one. It’s two close, so I check the higher, but the mouse anywhere in the bar. The highest, 8318. This high is eight. Three are one, fine, therefore this is a real time. Is this a ringed high? Obvious, this is not a ringed high. Is this a ringed high? Goodbye, this isn’t it. You can see this whole one of ours made a lower low. So, no, I don’t need to look at it. This is a while. What is this bar? By the way, it’s got a higher low and the lower high. We did it yesterday. Remembers the name of this one?

Yes, good. Don’t worry, if not a good, good effort. Yeah, it is an inside bar, inside of the previous well done. Is this are ring high. What I’m called. These two are not ring highs. This is the and after that, you have ring high here. I’m going

to pick a chart. We’re going to do the same thing. You’re going to focus on. It’s not a train track that was an inside part. This could be really that area, but good for you, sort of throw you in the deep end. Slow down. You need to slow your brains down, not going on devices are so going to go with this tight area, we’re going to do two examples where we put the bias you same

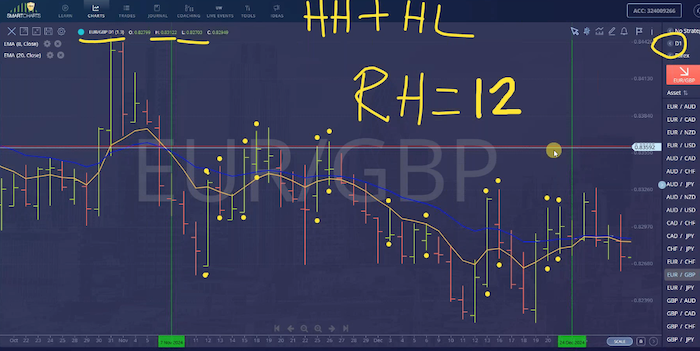

thing. Please. Double check the asset we’re on Euro GBP daily. Double check, I want to know how many ringed highs we have. Here’s the first so ring high is the first ring.

So again, please count twice two times and post answers in the box.

There were 12 ring highs in total, this is an exercise that one thing is for sure, if you guys, you guys were in a classroom environment, or if you had a training, it would be easier to do this exercise. It’s good to do it in the group.

Doing it alone does take a lot of discipline, because it’s boring, but it’s necessary. Look at how many ringed highs are in this window. That means, if you can spot over your eyes, you’ve eliminated at least 50% of these bars, and then the rest of the bars become easier, because you’ll go, oh, there’s an inside bar. You bar. There’s a continuation bar, no. High test bar, high test continuation, high test before you know it, continuation outside you’ve known and nailed every single bar. Well done and sent you. Yeah. Well done to all of you, let’s do one more. Do one more quick one before we wrap up, I’m going to do at least two exercises that makes it fair. Let’s do one more ring highs. Let’s do this. Do this window here. This is a nice small window, which I think will be like we did last time, see if I can get you you’re going to go from the 25th of February this Year, 26 February.

Change we’re going to count all the ring highs from there until today. Please ignore today’s bar. Today’s bar isn’t finished, so that Market, please count all the ringed highs.

A very good effort. Lots of you, you guys, get my messages, by the way. So you know, very good. Very good. There are all I hear the answer if you made a mistake and correct your answer, there are five ringed highs. If you got any more, any less, you can see where five are. If this is an area that you’re not strongest in, and you feel that you’ve sort of got your head around time frame agreement.

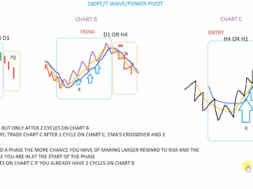

The purpose of doing ring highs and ring lows is so that when you go to lower time frames and decide you want to trade, or you do your time frame analysis. If you’re wanting, you’re wanting to get in on a one hour, it means you can trade a ring high or a ring low. Means there’s no issue. You would simply go here. You’re right in here, ring high or you can even 180, we know what a 180 is. It also means when we’re in this predicament. This is why I am showing you this at a different level. Look at this.

This is both a low test and a ringed low bouncing of the 200 but because the yellow is below the blue, you’re not going to get the signal, even if it was on the four hour even if it was on the four hour or the daily. I say to you, well, I want you to trade this. We’re gonna want to trade down. I’m not going to get a 180 Here am I, because the yellow is above the blue.

So Smart Charts, eventually you will find you in certain zones. It works perfectly here. But if you were to trade in this area, there would have to be another strategy, like when I was showing you this afternoon. But at least now you have the licence to say, well, actually. I like the trading off the daily or trading off the daily 100 or the 200 and I’m going to trade a ringed low here manually. I’m going to trade off this area and not stress. That’s the beauty of this. Any questions comments before we go for a break, if you feel that this is not what you’d want to work on, and you are taking my comment about the importance of timeframe correlation. correlation exercise we did this morning, chart B and C.