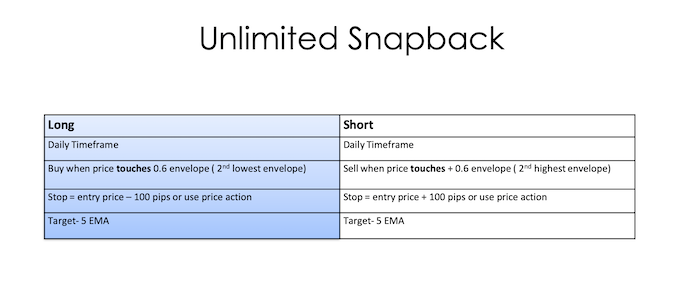

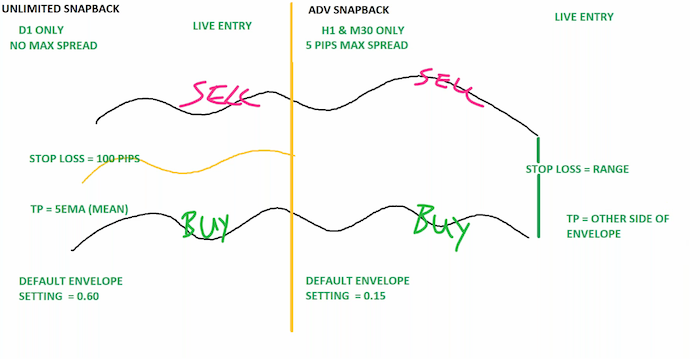

Unlimited Snapback

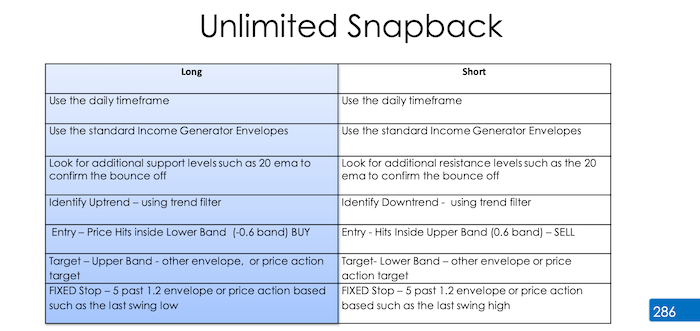

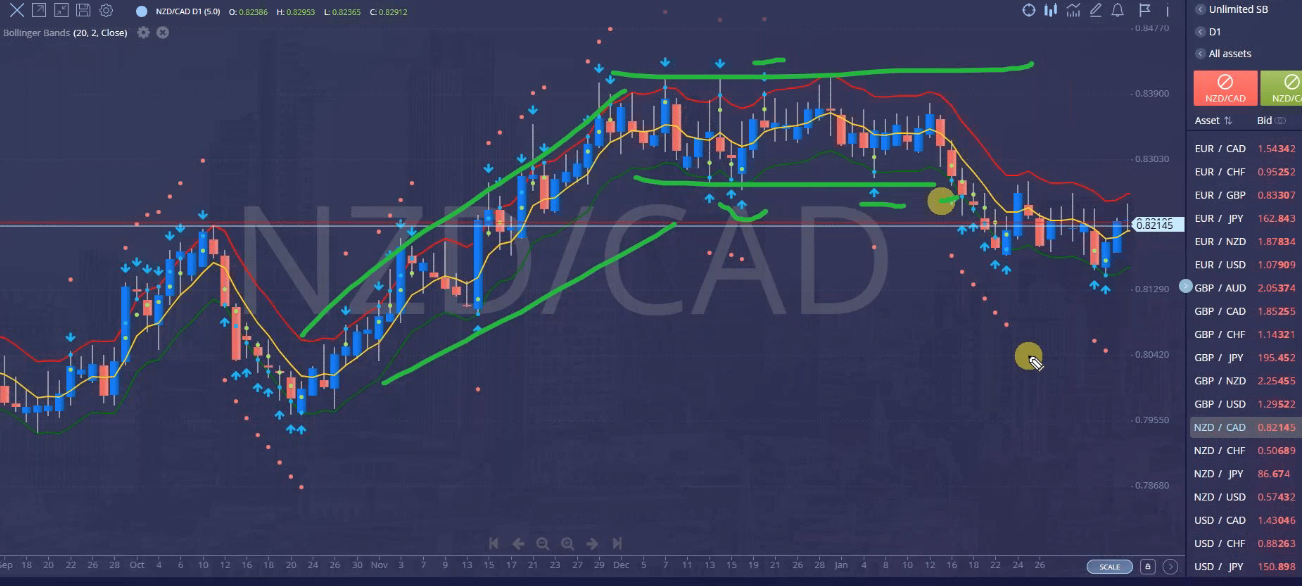

This is a daily trade that requires a ranging market (trading this in trend and especially countertrend is highly risky).

We need to see at LEAST 4 ranging bars before entry. The character indicator can be used to confirm range.

We use the 0.6 setting for the Envelopes but these can be changed as you see fit.

Unlimited Snapback

We can trade this as a trending strategy by only taking the trend based trades in a trending market.

This is essentially called Unlimited but it’s really a Daily Snapback.

Live entry and target needs to be moved throughout the day so you need to check the screen several times each day.

We’re looking for the price to touch the lower band. This is an old instruction, because we’ve actually got rid of second band.

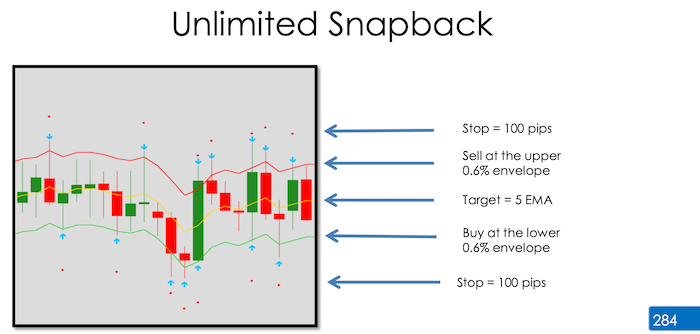

The stop loss is 100 pips. We covered this before using price action, adding the stop loss ourselves, where the trade becomes invalid.

The target is the 5 EMA. This diagram here should tell you what you’re looking for. Look, and we love the unlimited snap back, because when the market is not doing very much, you will do well meaning that you will get your 3% trading something like this.

Page 284, is a printout above, because the same rules apply for the advanced snapback. Sell at the upper envelope, we buy at the bottom envelope. Stop losses go below. Stop losses go above, and we target the 5 Ema, this has a very similar stop loss and take profit to the 20 bounce, because you’ll be risking 100 pips go for the middle, which would be roughly around 50 pips.

Now the target is a five moving average, which means it moves hence the name moving average. So you’re going to be changing your take profit every time – 5 EMA, it moves at the end of every bar, you move your take profit to the 5 EMA, please make a note of that you’ve got a target that is on an envelope or a moving average, your take profit will have to move. It will move. If you don’t you’ll be taken out either for a profit or a loss.

Can be used for trends but there are othe strategies so stay focusing on this range.

Little shortcut. For those that know, if you don’t know what this is, join the next Advanced Boot Camp. You’ll learn it. Or watch the end of the Advanced Boot Camp last hour one. You’ll see what I’m going on about here. (Currencies close in price often range)

These envelopes, they’re very cool, because you can see very quickly what the market is doing what is trending, which means you can also see what the market is up to. Everyone look and then look difference is glaringly obvious, which means you’re able to use the unlimited snap back envelopes, even as a guide to help you with market identification. You don’t need the market to tell you.

This is also where some of you might get clever and do this, You get to see a Bollinger band with an envelope, and you can use the squeeze to help you, because you know, when the market breaks out of the squeeze, it is probably going to continue. So this environment here would have been perfect to say, I’m going to trade sideways in this whole area. Then when it breaks out, I’m going to stop selling, start looking for buy opportunities, because now I know I’ve got a trend. That’s the beauty of being kicked out of a range or a trend means the market might be changing, and you would change with it.

There are no green dots, by the way, because the green dot would be on the yellow (5 EMA) and the yellow moves. There is a green dot, but it’s not accurate. The green is 20 pips away. You need to move the green manually to the yellow but as we’re looking at this, observing that this has hit target because we’ve reached the yellow line.

Every single one of these have reached target because they’re reaching the yellow line. Ignore the green.on the unlimited snapback, it is at 20 hits, which is not correct. Would need to adjust it to the yellow line. Or close the trade manually on the yellow line.

We adjust the take profit with the yellow so by the time that kicks you out you are kicked out for a full 1%.

Stop expecting the market to give you the conditions you want. Just look at the conditions it’s currently in. It’s currently trending. I’m not going to take any of these sell signals. Why are there sell signals there? Because when a market is trending, it will touch the upper band. The algorithm doesn’t switch itself off, doesn’t know how to that’s where we come in. We’ve got to do the analysis to decide whether the market conditions are correct.

Summary.

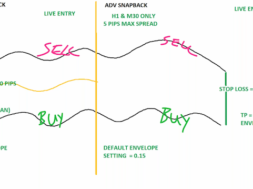

This is a labour intensive trend that has a ‘brother in ‘advanced snapback’ (H1 and M30)

You have to move the take profit and stop loss manually. Its a live strategy so as soon as you click you are in the market.